HTS code- what is it means and how do I classify my products

Question:

Customs classification – how do I classify my products?

Answer:

What are HS codes?

HS Codes (or HTS Codes), also known as the Harmonized Commodity Description and Coding System, or simply the Harmonized System, are a standardized international system to classify globally traded products. The system was first implemented in 1988 and is currently maintained by the World Customs Organization.

The HS codes are 6 digits, divided into three parts:

The first two digits (HS-2) identify the chapter the goods are classified in, e.g., 09 = Coffee, Tea, Maté and Spices. The next two digits (HS-4) identify groupings within that chapter and the last two digits (HS-6) are even more specific.

Usually, your supplier will be able to provide you with the HTS code, however, take note that many Chinese suppliers will give you the Chinese version of the HTS code. Since the first 6 digits of the HTS code are the universal HS code, you will need to determine the last 4 digits of the HTS code for import into the USA, using the attached table of tariffs. The HTS code provides an estimate of the customs fees you'll have to pay at the time of import.

You can use the below website to check classification for your products, in the US only: https://hts.usitc.gov .

For example:

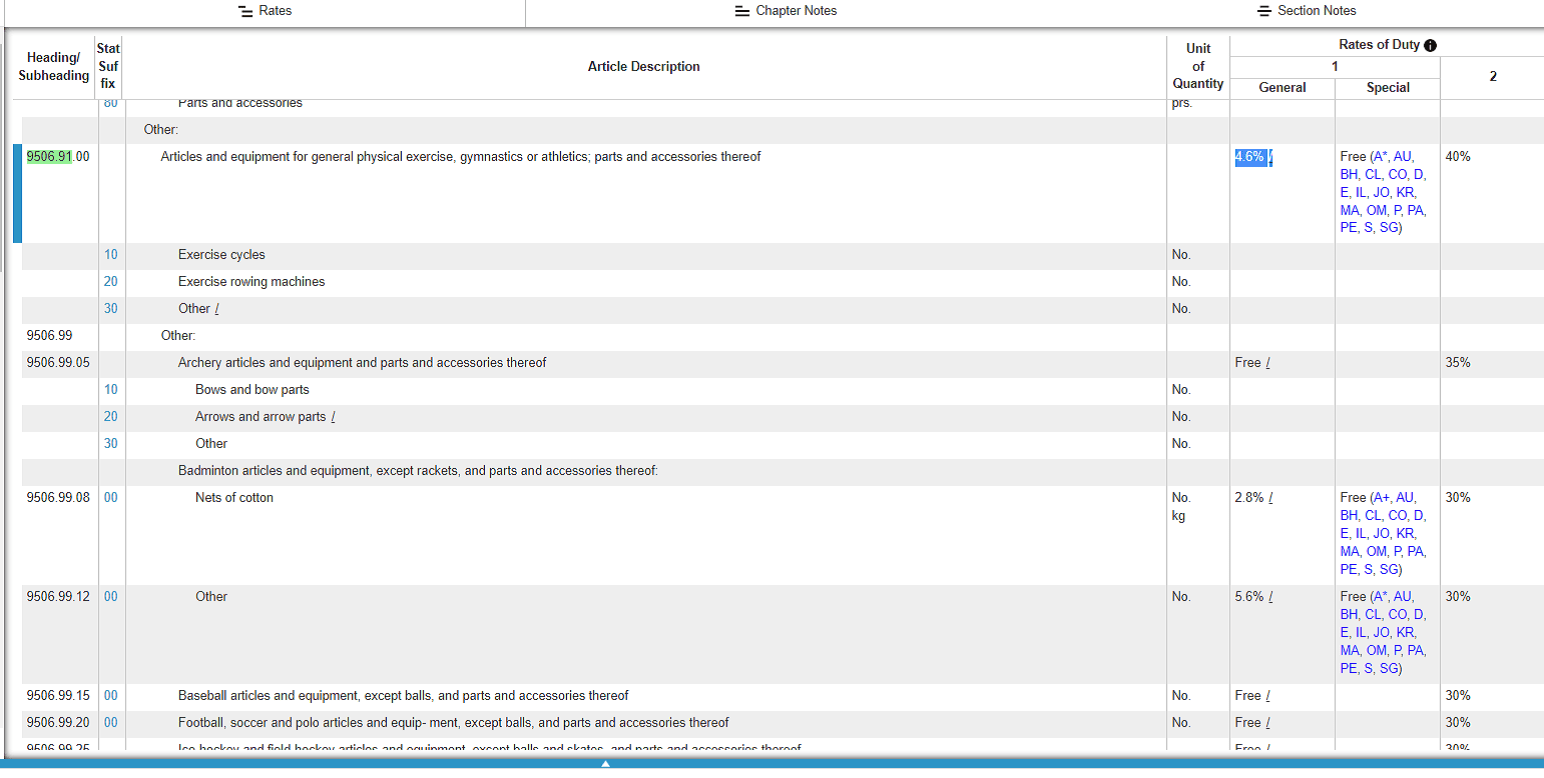

Sports gear is usually classified under 9506.91

Customs duty are 4.6% - refer to attached example from the above classification website.

However, if we hover the cursor over the ‘/’ that is right next to the 4.6%, we’ll see many other codes that apply for the same product.

Considering all attached codes, we can understand that this specific product has a 7.5% (9903.88.15) on top of the original customs duty. Some of us, refer to this additional tax as the “Trump” tax.

To summarize, the customs duty for this product is: 4.6% + 7.5% = 12.1% duty

The duty percentage of a new product is, therefore, an important factor to consider when determining its profitability.

Despite making a delivery under DDP conditions, most sellers ignore products with high customs percentages and don't even understand what they mean.

By consulting a shipper about a potential product and its classification before production begins, thousands of dollars can be saved in the long run and can make or break a product’s profitability.

It is important to keep in mind that the final decision regarding product classification is determined by the customs authority alone, and it can always announce that the classification is incorrect and request a correction.

Merchants selling internationally should be aware that different countries can apply different customs percentages to the same customs classification / HTS code.

Our sports products, for instance, have a total of 12.1% customs duty in the USA (per the classification 9506.91), while in Canada, the same product with the exact same HTS code has 0% duty (exempt from duty).