Marine insurance – Meaning, types, benefits & coverage.

Question:

Do I need to add marine insurance to my freight when shipping goods from my manufacturer?Answer:

That’s a great topic and it has many aspects.

To give a straight answer- Proboxx highly recommends to add marine insurance for any

freight. You get to sleep well at night knowing your goods are covered.

What is Marine Insurance?

Marine insurance refers to a contract of indemnity. It is an assurance that the goods

dispatched from the country of origin to the land of destination are insured. Marine

insurance covers the loss/damage of ships, cargo, terminals, and includes any other means

of transport by which goods are transferred, acquired, or held between the points of origin

and the final destination.

The term originated when parties began to ship goods via sea. Despite what the name

implies, marine insurance applies to all modes of transportation of goods. For instance,

when goods are shipped by air, the insurance is known as the contract of marine cargo

insurance.

Importance of Marine Insurance

Marine insurance is required in many import-export trade proceedings. Admitting the terms,

both parties are liable for the payment of goods under insurance. However, the subject

matter of marine insurance goes beyond contractual obligations, and there are several valid

arguments necessary for buying it before dispatching the export cargo.

How Does Marine Insurance work?

Marine insurance best transfers the liability of the goods from the parties and intermediaries

involved to the insurance company. The legal liability of the intermediaries handling the

goods is limited to begin with. The exporter, instead of bearing the sole responsibility of the

goods, can buy an insurance policy and get maritime insurance coverage for the exported

goods against any possible loss or damage.

The carrier of the goods, be it the airline or the shipping company, may bear the cost of

damages and losses to the goods while on board. However, the compensation agreed upon

is mostly on a ‘per package’ or ‘per consignment’ basis.

The coverage provided may not be sufficient to cover the cost of the goods shipped.

Therefore, exporters prefer to ship their products after getting it insured the same with an

insurance company.

Type of Marine Insurance

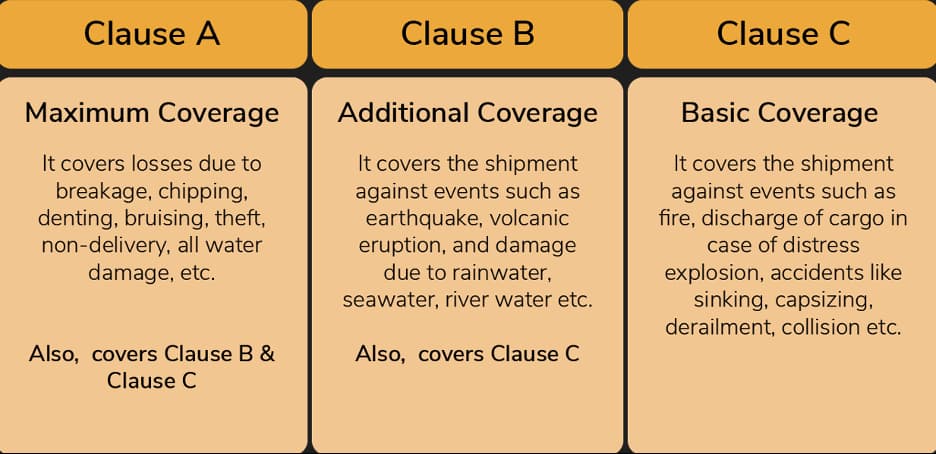

Institute Cargo Clause A - provides maximum coverage as it covers all risk of loss or damage

to the goods. Apart from the risks covered under Clauses B and C, it also covers losses due to

breakage, chipping, denting, bruising, theft, non-delivery, all water damage, etc.

Risks such as wars, strikes, riots, and civil commotions are not covered under the institute

cargo clauses. However, the insurer may provide this cover on payment of additional marine

insurance premium.

Institute Cargo clause B - offers an additional layer of protection. Not only does it include all

the risk covers provided under Clause C, but it also covers the shipment against events such

as earthquake, volcanic eruption, and damage due to rainwater, seawater, river water, etc.,

and loss to package overboard or during loading and unloading.

Institute Cargo Clause C - provides basic coverage and includes a restricted list of risk covers.

It covers the shipment against events such as fire, discharge of cargo in case of distress,

explosion, accidents like sinking, capsizing, derailment, collision, etc.

So in terms & conditions of marine insurance coverage, these three types of marine

insurance clauses: Institute Cargo Clauses A, B, and C. Clause A provides maximum coverage,

Clause C provides basic risk coverage.