Selling in UK? Check a valuable info for your success in the UK

Question:

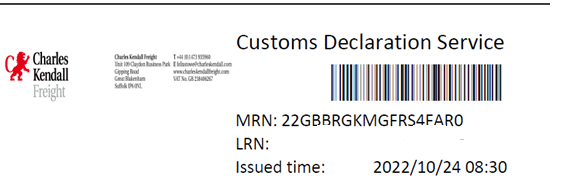

I am a seller on Amazon UK and I received a request to update my MRN No on Seller Central.

What’s this? From where can I get this no. and is my forwarder able to provide it?

Answer:

Let’s take it step by step

We’ll start with the definition: an MRN No is issued by the customs authorities in England (form C88).

An import record, form C88, will be issued by your customs broker or forwarder after customs clearance at destination.

For general VAT enquiries use the following link

https://www.gov.uk/government/organisations/hm-revenue-customs/contact/vat-enquiries

As a side note – VAT credits can only be claimed if the original form is submitted to your accountant (Form C79 will be sent directly to your address in England).

For any further C79 certificate requests please contact cbc-c79requests@hmrc.gov.uk

MRN #No stands for Movement Reference Number. The Customs Authority issues a Movement Reference Number (MRN) in each member state. The MRN number is the customs registration number that enables the customs authority to identify and process your shipment in the customs system. It is the primary reference for customs declarations and the most important link with your goods. Each time an import or export declaration is submitted to any of the Customs Authorities in the European Union or the United Kingdom, a unique number is created for that shipment.

An MRN is 18 characters long. The first two characters are the year in which the goods are shipped, The next two characters are the two-letter country code of the country where the shipment. The last 14 characters are an alphanumeric code which is automatically generated by the Customs Authority.

Why Do I Need an MRN?

The Directorate-General for Taxation and Customs Union has published that European Customs transit is a customs procedure used to facilitate the movement of goods between two points of a customs territory, via another customs territory, or between two or more different customs territories. It allows for the temporary suspension of duties, taxes and commercial policy measures that are applicable at import, thereby allowing customs clearance formalities to take place at the destination rather than at the point of entry into the customs territory.

Now, for the big question -

As a seller I ship goods to US under DDP only.

When I contacted my forwarder, he advised me that for UK - they can ship only under DDU. Why??

Should Amazon suspect that sellers didn't pay the UK VAT or any other issue, they will notify HMRC (UK Tax). Amazon will stop providing FBA services to sellers if the VAT is not received after 0 days. Amazon will fine sellers who don't align 3,000 GBP or revoke their license if they don't align.

Currently, Amazon allows 240 days for the sellers to provide the IEN, so there is enough time to prepare. Set you EORI + VAT No. to UK prior to any RFQ you send to a forwarder to ensure smooth operations

Notes:

* For general VAT enquiries use the following link:

https://www.gov.uk/government/organisations/hm-revenue-customs/contact/vat-enquiries

* For any further C79 certificate requests please contact:

* For Duty Deferment statements or queries contact CDO enquiries on: